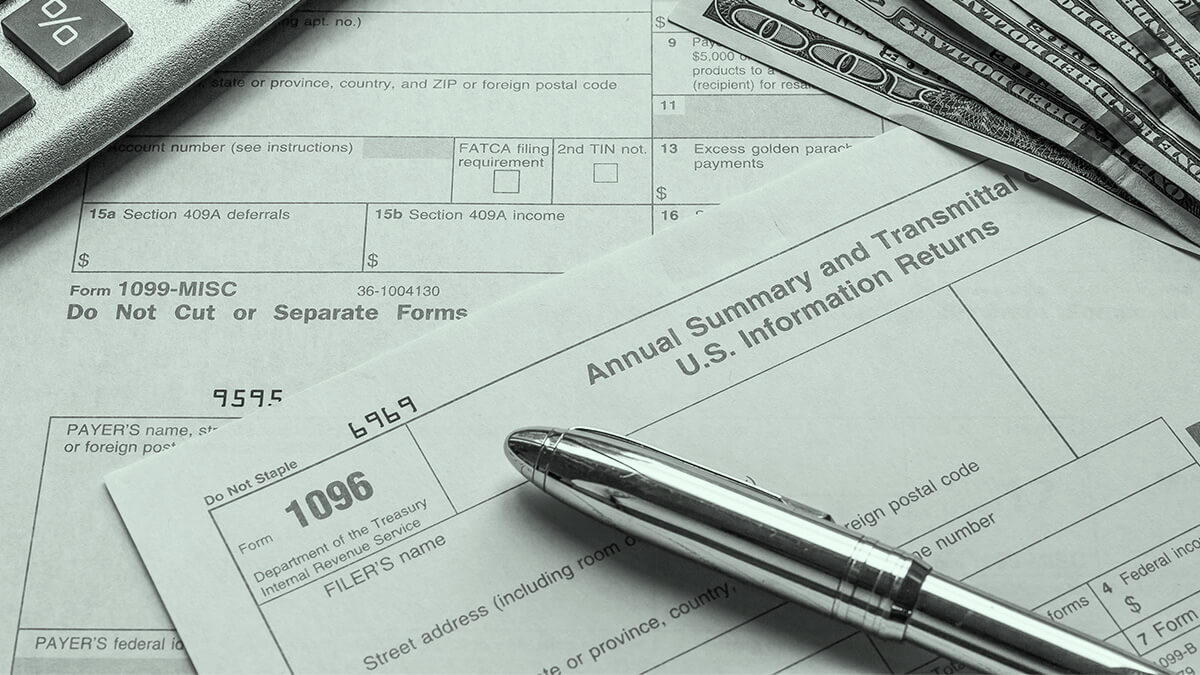

1096 Due Date 2024 Taxes Free – W hat do I need to know about withholding and estimated taxes?Can I get an extension to pay my taxes?What if I don’t pay enough on time?Is unemployment compensation taxable?Key . Due dates are as follows for those who pay taxes quarterly: Jan. 1-March 31 pay period: April 15 Apr. 1-May 31 pay period: June 15 June 1-Aug. 31 pay period: Sept. 15 While the IRS Free File .

1096 Due Date 2024 Taxes Free

Source : form-1096.pdffiller.com1099 Forms | Printable 1099 Forms | 2022 / 2023 Blank 1099

Source : www.realtaxtools.com1096 Tax Forms: Printable For QuickBooks & IRS Submittal

Source : intuitmarket.intuit.comE File Form 1099 NEC Online in 2024! BoomTax

Source : boomtax.com2019 2024 LTCFEDS Informal Caregiver Invoice Fill Online

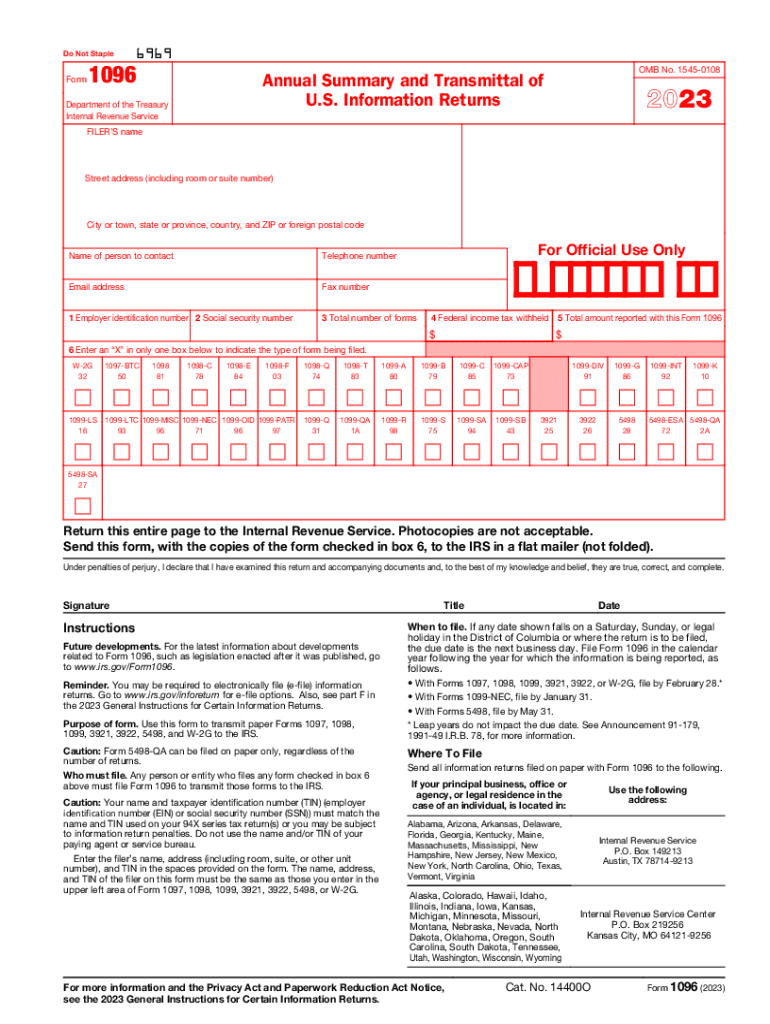

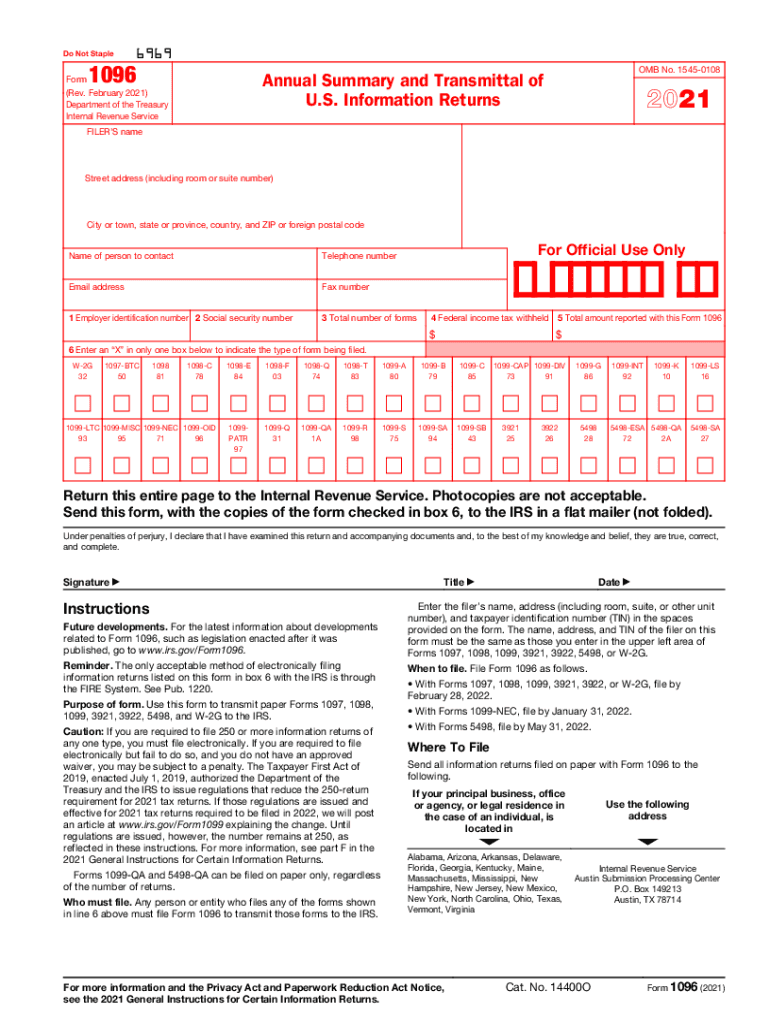

Source : invoice-homecare-service.pdffiller.comForm 1096 | Annual Summary and Transmittal of Returns

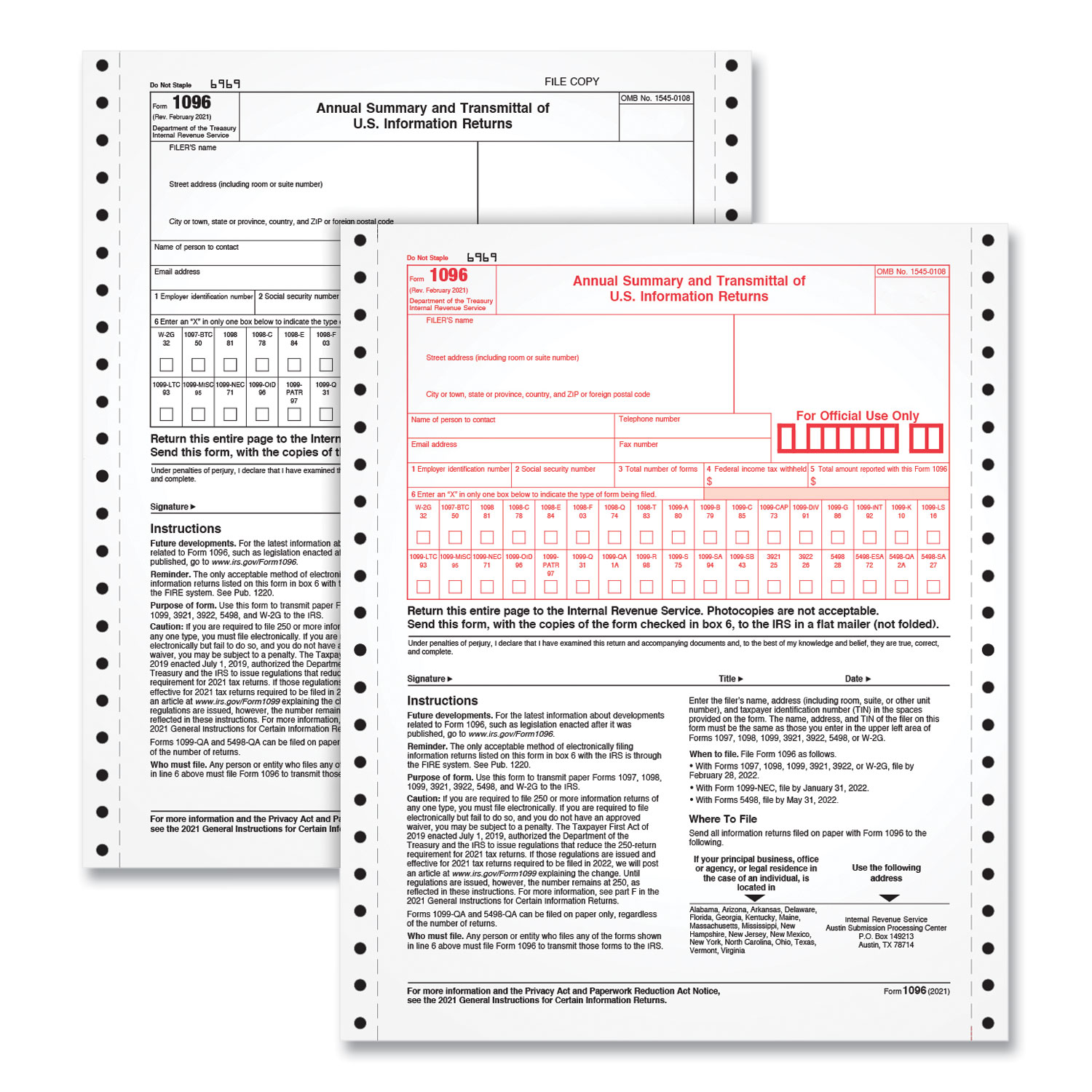

1096 Tax Form for Dot Matrix Printers, Fiscal Year: 2023, Two Part

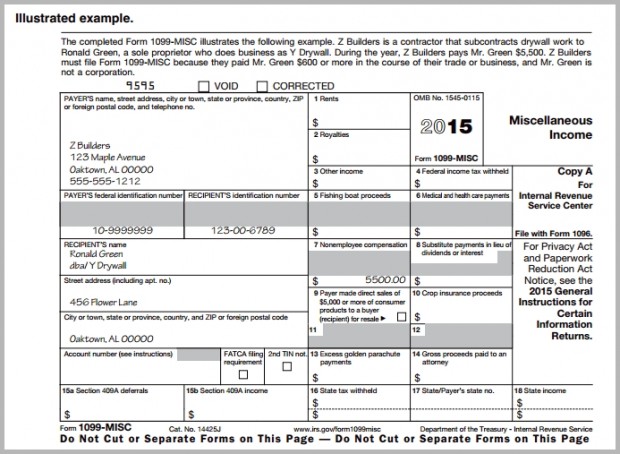

Source : www.mastersupplyonline.comPrintable IRS Form 1099 MISC for 2015 (For Taxes To Be Filed in

Source : www.cpapracticeadvisor.com1096 form: Fill out & sign online | DocHub

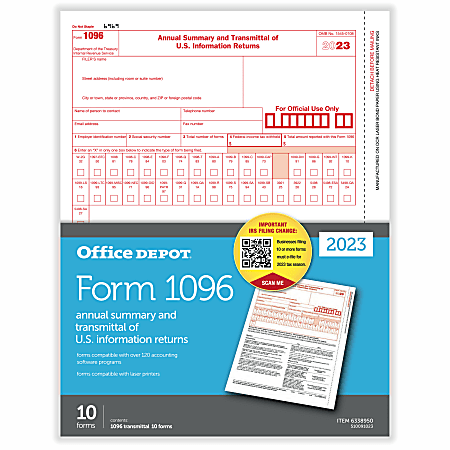

Source : www.dochub.comOffice Depot Brand 1096 Laser Tax Forms 1 Part 8 12 x 11 Pack Of

Source : www.officedepot.com1096 Due Date 2024 Taxes Free 2023 Form IRS 1096 Fill Online, Printable, Fillable, Blank pdfFiller: The IRS announced the tax brackets for the tax year 2024 in November. The agency said in a press release that the top tax rate remains 37% for individual single taxpayers with incomes greater than . Here are answers:Tax season can be terrifying. Here’s everything to know before filing your taxes in 2024 Jan. 12: IRS Free File opens. Jan. 16: Due date for 2023 fourth quarter .

]]>